Request Payments

What is Request Payments

FedNow, Requested Payments and Real-Time instant payments, are defined simply as: Irrevocably collected funds in a bank account and usable immediately by the owner of the account. Our "Good Funds" payment gateway allows for instant real-time digital payments that are immediate, irrevocable, intra-bank and/or interbank account-to-account (A2A) transfers that utilize a real-time messaging system connected to every transaction participant through all U.S.-based financial institutions.

Using ISO 20022 Messaging for Recurring Payments with RfP

Overview: ISO 20022 is an international standard for electronic data interchange between financial institutions. It provides a common platform for the development of messages, ensuring uniformity and interoperability across various payment systems. The Request for Payment (RfP) feature, under this standard, enables businesses to request payments for recurring transactions from multiple payers.

Key Features and Benefits:

ISO 20022 Messaging Specification:

- Standardized Communication:

- ISO 20022 provides a standardized messaging framework that ensures consistency and clarity in financial communications.

- Enhances interoperability between different financial institutions and payment systems globally.

- Rich Data Format:

- Allows for detailed and structured data to be included in messages, improving the transparency and information flow.

- Supports complex payment scenarios, including recurring payments and multiple payer requests.

- Request for Payment (RfP):

- An RfP under ISO 20022 can include all necessary payment details, such as the amount due, due date, invoice reference, and any applicable late fees.

- Facilitates automated processing and reconciliation of payments.

Benefits for Recurring Payments:

- Automated Payment Collection:

- Streamlines the process of collecting recurring payments by automating the invoicing and payment request process.

- Reduces administrative overhead and minimizes the risk of errors.

- Improved Cash Flow Management:

- Ensures timely receipt of payments, enhancing liquidity and financial planning.

- Provides predictability in cash flow through scheduled and automated collections.

- Enhanced Customer Experience:

- Simplifies the payment process for customers by providing clear and standardized payment requests.

- Supports multiple payment methods and platforms, increasing convenience for payers.

- Security and Compliance:

- ISO 20022 ensures secure and compliant messaging standards, protecting sensitive financial information.

- Reduces the risk of fraud and errors through standardized and transparent communication.

Implementation Steps:

- Set Up ISO 20022 Messaging:

- Ensure your financial institution supports ISO 20022 messaging for payment processing.

- Integrate ISO 20022 capabilities into your existing payment and accounting systems.

- Configure Request for Payment

(RfP):

- Set up RfP templates within your system, incorporating all necessary details for recurring payments.

- Customize the templates to include information such as the amount, due date, invoice reference, and late fees.

- Automate Recurring Invoices:

- Schedule recurring invoices in your accounting software (e.g., QuickBooks Online) to be sent automatically.

- Use SecureQBPlugin.com or similar integration tools to connect your accounting software with ISO 20022 messaging capabilities.

- Send and Manage RfP:

- Send RfP messages to multiple payers for their recurring payments.

- Monitor the status of requests and payments through real-time notifications and updates.

- Reconcile Payments:

- Automatically reconcile received payments with outstanding invoices in your accounting system.

- Utilize reporting tools to analyze financial data and manage cash flow effectively.

Example Use Case:

Scenario: A subscription-based service provider needs to collect monthly fees from multiple customers. By leveraging ISO 20022 messaging for RfP, the provider automates the payment collection process.

- Initiate RfP: The provider sets up recurring invoices in QuickBooks Online and schedules RfP messages to be sent automatically each month.

- Process Payments: Customers receive RfP messages, review the details, and approve the payments. Funds are transferred instantly using real-time payment systems.

- Reconciliation: Payments are automatically recorded and reconciled in the provider’s accounting system, ensuring accurate financial records and improved cash flow management.

For more detailed information and support, you can explore the specific services offered by SecureQBPlugin.com and the resources available for ISO 20022 messaging.

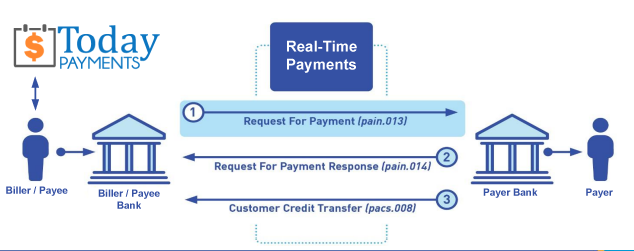

Creation Request for Payment Bank File

Call us, the .csv and or .xml FedNow or Request for Payment (RfP) file you need while on your 1st phone call! We guarantee our reports work to your Bank and Credit Union. We were years ahead of competitors recognizing the benefits of RequestForPayment.com. We are not a Bank. Our function as a role as an "Accounting System" in Open Banking with Real-Time Payments to work with Billers to create the Request for Payment to upload the Biller's Bank online platform. U.S. Companies need help to learn the RfP message delivering their bank. Today Payments' ISO 20022 Payment Initiation (PAIN .013) shows how to implement Create Real-Time Payments Request for Payment File up front delivering a message from the Creditor (Payee) to it's bank. Most banks (FIs) will deliver the message Import and Batch files for their company depositors for both FedNow and Real-Time Payments (RtP). Once uploaded correctly, the Creditor's (Payee's) bank continues through a "Payment Hub", will be the RtP Hub will be The Clearing House, with messaging to the Debtor's (Payer's) bank.

... easily create Real-Time Payments RfP files. No risk. Test with your bank and delete "test" files before APPROVAL on your Bank's Online Payments Platform.

Today Payments is a leader in the evolution of immediate payments. We were years ahead of competitors recognizing the benefits of Same-Day ACH

and Real-Time Payments funding. Our business clients receive faster

availability of funds on deposited items and instant notification of

items presented for deposit all based on real-time activity.

Dedicated to providing superior customer service and

industry-leading technology.

1) Free ISO 20022 Request for Payment File Formats, for FedNow and Real-Time Payments (The Clearing House) .pdf for you manually create "Mandatory" (Mandatory .csv or .xml data for completed ISO 20022 file) fields, start at page 4, with "yellow" highlighting. $0.0 + No Support

2) We create .csv or .xml formatting using your Bank or Credit Union. Using your invoice information database to create an existing Accounts Receivable file, we CLEAN, FORMAT to FEDNOW or Real-Time Payments into CSV or XML. Create Multiple Templates. You can upload or "key data" into our software for File Creation of "Mandatory" general file. Use either the Routing Number and Account Number for your Customers or use "Alias" name via Mobile Cell Phone and / or Email address.

Fees = $57 monthly, including Activation, Support Fees and Batch Fee, Monthly Fee, User Fee. We add your URI for each separate Payer transaction for additional Payment Methods on "Hosted Payment Page" (Request for file with an HTML link per transaction to "Hosted Payment Page" with ancillary payment methods of FedNow, RTP, ACH, Cards and many more!) + $.03 per Transaction + 1% percentage on gross dollar file,

3) Add integrating QuickBooks Online "QBO" using FedNow Real-time Payment using our Requested Payments system.

Fees Above 2) plus $29 monthly additional QuickBooks Online "QBO" formatting, and "Hosted Payment Page" and WYSIWYG

4) Above 3) plus Create "Total" (over 600 Mandatory, Conditional & Optional fields of all ISO 20022 Pain .013) Price on quote.

Each day, thousands of businesses around the country are turning their transactions into profit with real-time payment solutions like ours.

Contact Us for Request For Payment payment processing